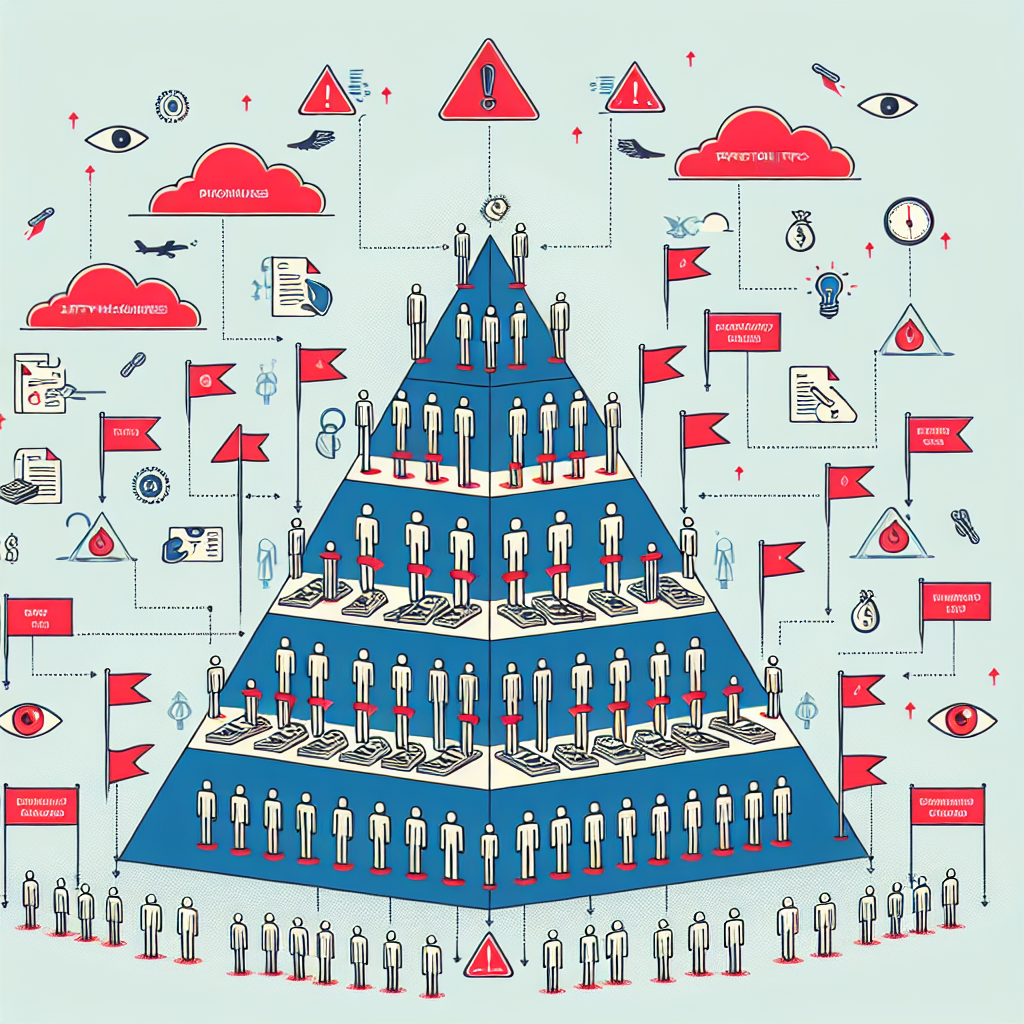

A Ponzi scheme lures investors by offering abnormally high returns. It uses the funds from new investors to pay earlier investors. This creates an illusion of a profitable business. However, Ponzi schemes are doomed to fail. Eventually, they collapse when the influx of new investors dries up.

How Does a Ponzi Scheme Work?

A Ponzi scheme operates on a simple but deceitful principle. Here are the key steps:

- Promise of High Returns: The scammer promises unusually high returns with little to no risk.

- Recruitment: Initial investors are convinced by these promises and decide to invest.

- Fake Reports: The scammer uses the money from new investors to pay off the earlier investors, creating a fake appearance of profitability.

- Collapse: The scheme collapses when there are not enough new investors to sustain it.

Red Flags of a Ponzi Scheme

Awareness is crucial to avoid falling victim. Here are the common warning signs:

| Red Flag | Description |

|---|---|

| Unusually High Returns | Promises of returns that are too good to be true. |

| Consistent Returns | Returns are consistently high, regardless of market conditions. |

| Unregistered Investments | The investment is not registered with regulatory authorities. |

| Complex Strategies | The investment strategies are overly complex or secretive. |

| Unlicensed Sellers | The person or firm offering the investment is not licensed. |

| Pressure to Reinvest | There’s a push to reinvest instead of withdrawing profits. |

Prevention Tips

Preventing involvement in a Ponzi scheme requires caution and awareness. Here’s how:

Verify the Legitimacy

Ensure the investment is registered with the authorities. Verify the credentials of the firm and individuals involved.

Understand the Investment

Always understand how the investment works. Avoid overly complex and secretive schemes.

Be Skeptical of High Returns

High returns with low risk are usually a red flag. Be cautious of consistently high returns regardless of market performance.

Don’t Fall for Pressure Tactics

Scammers often pressure investors to reinvest profits. Take your time to make decisions without pressure.

Diversify Your Investment

Don’t put all your capital into one investment. Diversifying helps reduce risk.

In-Depth Questions and Answers

How can you differentiate between a legitimate investment and a Ponzi scheme?

Registration and Licensing

Legitimate investments are usually registered with authorities like the SEC. Always verify the registration status. Licensed professionals should handle investments. Ask for their credentials and check with regulatory bodies.

Transparency

Legitimate companies provide clear and understandable information. They explain the investment strategy and risks transparently. Ponzi schemes often use vague or overly complex terms to confuse investors.

Returns Consistency

No investment consistently yields high returns despite market conditions. Assess the offered returns critically. Investigate companies boasting unusually consistent high returns as they might be Ponzi schemes.

What are the common psychological tactics used by scammers?

Fear of Missing Out (FOMO)

Scammers create a sense of urgency. They pressure investors to act quickly, fearing they might miss out on a "once-in-a-lifetime" opportunity.

Social Proof

They use testimonials or "successful" investors to convince new victims. Seeing others profit can trigger trust and endorsement.

Authority Bias

Scammers present themselves as experts. They might use fake titles or fabricated awards to gain trust.

Promises of Security

They promise guaranteed returns, luring individuals who seek financial security. This plays on the natural desire for stability.

What should you do if you suspect you’re involved in a Ponzi scheme?

Cease Further Investments

Stop contributing more funds immediately. Continuing to invest only deepens your potential losses.

Report to Authorities

Report your suspicions to regulatory bodies like the SEC or local law enforcement. Timely reporting can help prevent others from becoming victims.

Consult a Legal Professional

Seek legal advice to understand your options. A lawyer specializing in financial fraud can guide you on the next steps.

Reach Out to Support Groups

There are support groups for victims of financial scams. Organizations like the National Association of Victims of Ponzi Schemes offer assistance and resources.

How do Ponzi schemes affect the broader economy?

Loss of Investor Trust

Ponzi schemes diminish trust in financial markets. Investors become wary, affecting legitimate businesses.

Economic Instability

Large Ponzi schemes can create economic ripples. When they collapse, large sums of money evaporate, leading to financial instability.

Legal and Regulatory Costs

Authorities spend significant resources to investigate and litigate these schemes. This diverts funds from other essential areas.

Social Impact

Victims often face severe financial and emotional distress. This can lead to broader societal issues, including increased crime rates.

Additional Resources

If you’re eager to learn more, visit Red Flag Scammers for in-depth guides and articles on financial scams. Protect yourself and your finances by staying informed.