43% industrial loans of 16 banks, NBFIs now defaulted

Infographic: TBS

“>

Infographic: TBS

The amount of defaulted industrial loans has kept mounting with 16 banks and non-bank financial institutions (NBFIs) – most of them made the headlines for various scams in the past – being the worst sufferers, which, experts say, is attributable to sanctioning of large loans without proper credit risk assessment.

According to the Bangladesh Bank’s data, banks and NBFIs in the country have some Tk6.69 lakh crore in outstanding loans in the industrial sector until June this year, of which over Tk58,143 crore or about 9% have turned default. Three months ago, the volume of defaulted industrial loans was Tk52,372 crore.

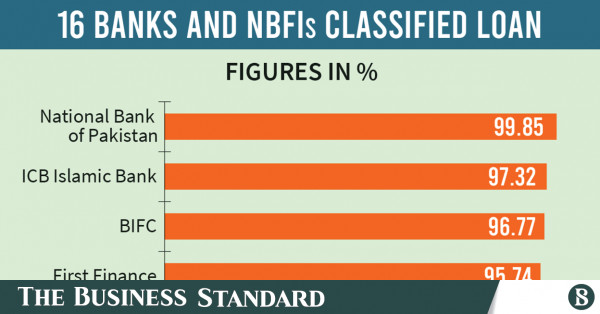

Surprisingly, the average rate of defaulted industrial loans of the 16 worst-performing financial institutions – including nine banks and seven NBFIs – is whopping 43.23% as Tk24,611 crore of their total outstanding industrial loans of Tk56,936 crore have turned bad. Individually, each of these institutions has at least 30% of their total outstanding industrial loans in default status.

The nine banks are BASIC Bank, Bangladesh Development Bank, Janata Bank, Sonali Bank, Rajshahi Krishi Unnayan Bank, ICB Islami Bank, National Bank of Pakistan, Bangladesh Commerce Bank, and Padma Bank, while the seven NBFIs are Bangladesh Industrial Finance Company, CVC Finance, First…