On the morning of Monday, September 26, 2022, I sent the following note to clients of Berkshire Money Management:

“Due to publishing deadlines, this column is never real-time. For investors, a five-day lag typically does not matter. But these aren’t typical times. I had opined that the mid-June lows for the market would be tested and, potentially, violated. On cue, stocks flirted with that test before the column was published.

“What’s next? First, I’ll try to find the silver lining of the dark clouds and look into some tax loss harvesting while the markets are down.

“Second, I’ll consider what type of ‘insurance’ to take out on portfolios. Earlier in the year, we made allocation changes from growth-oriented equity to value and ‘buffer funds.’

“Some days, I feel as if I am the only economist/financial advisor saying it, but the U.S. economy is in a recession. Since World War II, the average market decline during a recession is 31 percent; it could be worse or less. With the markets currently down more than 20 percent, the stakes are low at this point. The stock market’s returns after a recession one year, three years, five years, and ten years later are 21 percent, 48 percent, 100 percent, and 256 percent, respectively. It seems that a 10 percent-ish downside risk is worth it for that type of potential upside.

“But I still have concerns.

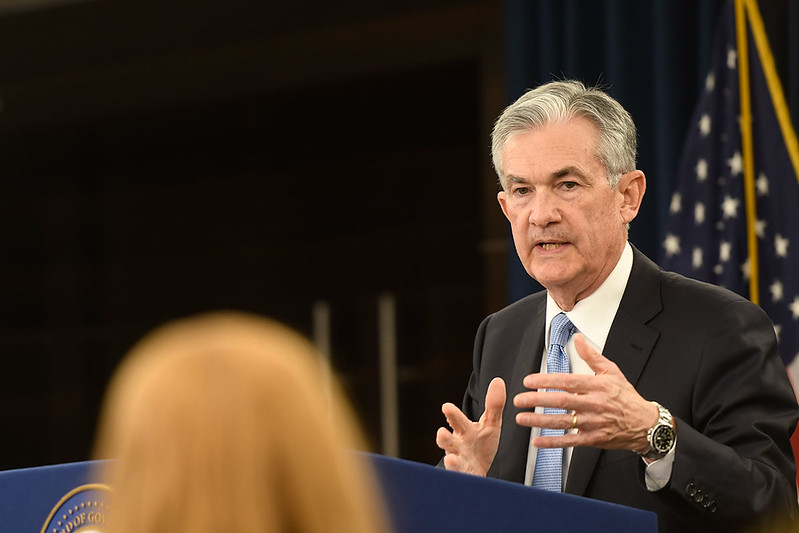

“During a Face the Nation interview on Sunday, September 25, 2022, Atlanta Fed President Raphael Bostic…